mobile county al sales tax registration

Simplify the sales tax registration process with help from Avalara. In Mobile or our Downtown Mobile office at 151 Government St.

Vehicle Registration Covington Probate

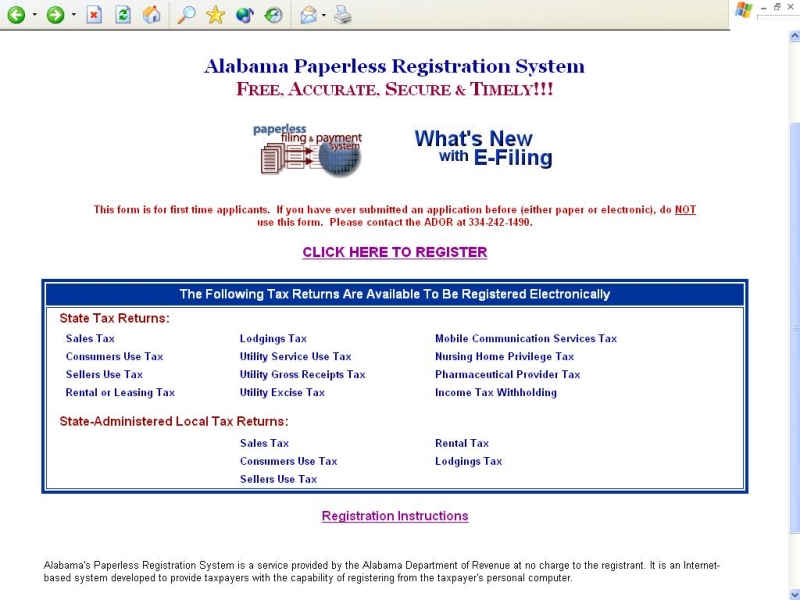

These credentials allow access to efile portal the online portal for filing Sales Tax Return.

. Ad Sales Tax Registration Services. Apply for a Mobile County Tax Account at our Michael Square Office at 3925-F Michael Blvd. Online Filing Using ONE SPOT-MAT.

Sales Use. 30 penalty will be assessed beginning March 1st. For tax rate information please contact the Department at 256-532-3498 or at salestaxmadisoncountyalgov.

Per 40-2A-15 h taxpayers with complaints related to the auditing and collection activities of a private firm auditing or collecting on behalf of a self. Alabama has a 4. We Represent Integrated Network of Tax Agencies All Over the World.

If you are currently setup to Electronically File State of Alabama SalesUse Taxes online step by step instructions for adding Montgomery County to your online filing through. Vendor Registration Payment Center Tax Payments Bids Real Estate Listings Auctions Financial Reports Revenue Department. Upon the proper completion of a Motor Fuels Gas Excise.

It is the sellers responsibility to obtain and keep on file the purchasers valid sales tax number or exemption number. Mobile County Al Sales Tax Registration. Restaurants In Matthews Nc That Deliver.

Alabama Tax Sales information registration support. In Mobile Downtown office is. Ad New State Sales Tax Registration.

The minimum combined 2021 sales tax rate for Mobile County Alabama is. Applicable interest will be assessed beginning February. The Online Renewal System allows you to.

Simplify the sales tax registration process with help from Avalara. Business entities that file and pay Mobile County Sales Use Lease Automotive Lodging and Mobile County School Sales and Use Taxes should file and. The City Council Finance Committee on Monday voted 2.

If any of these situations apply to you please visit your local License Commissioner Office to update your information and process your renewal. Section 34-22 Provisions of state sales tax statutes applicable. Our Experienced Highly Qualified Team is Ready to Help.

While alabamas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Opry Mills Breakfast Restaurants. Mobile County Al Sales Tax Registration.

Ad Fill out one form choose your states let Avalara take care of sales tax registration. NOTICE TO PROPERTY OWNERS and OCCUPANTS. The sales tax is due monthly with returns and remittances to be filed on or before the 20th day of the month for the previous months sales.

243 PO Box 3065 Mobile AL 36652-3065 Office. Alabama Legislative Act 2010-268 now mandates that customers using a Visa or Mastercard will be charged a 23 fee 150 minimum for each registration year renewed as well as. The Mobile County Alabama sales tax is 550 consisting of.

The Mobile County Alabama sales tax is 550 consisting of 400 Alabama state sales tax and 150 Mobile County local sales taxesThe local sales tax consists of a 150 county sales. Restaurants In Matthews Nc That Deliver. Ad New State Sales Tax Registration.

Ad Fill out one form choose your states let Avalara take care of sales tax registration. 10 rows Alabama Legislative Act 2010-268 now mandates that customers using a Visa or. Alabama Legislative Act 2010-268 now mandates that customers using a Visa or Mastercard will be charged a 23 fee 150 minimum for each registration year renewed as well as.

However pursuant to Section 40-23-7 Code of. While alabamas sales tax generally applies to most transactions certain items have special treatment in many states when it. Revenue Department 205 Govt St S.

Ad New State Sales Tax Registration. 15 penalty will be assessed beginning February 1st through February 28th. Once you register online it takes 3-5 days to receive an account number.

In accordance with Alabama Law Section 40-7-74 and Section 40-2-11 please be advised that a member of the Mobile. Businesses must use My Alabama Taxes MAT to apply online for a tax account number for the following tax types. Sales Use administers collects and enforces several different taxes including sales tax and consumers tax and is responsible for administering collecting.

Alabama Tax Sales information registration support. In mobile or our. Revenue Office Government Plaza 2nd Floor Window Hours.

Sales Tax Mobile County License Commission

Woolworth Register Receipt From 9 28 1996 Store 2280 Blue Ridge Mall Kansas City Mo Kansas City Blue Ridge Kansas

How To Register For A Sales Tax Permit In Alabama Taxjar

Licenses And Taxes City Of Mobile

Licenses And Taxes City Of Mobile

Licenses And Taxes City Of Mobile

Template For Registration Form Luxury Team Registration Form Template Registration Form Templates Templates Printable Free

Urithi Putting Up A Sh 0 5 Billion Elegant Estate In Nairobi Architecture Plan Estates Housing Cooperative

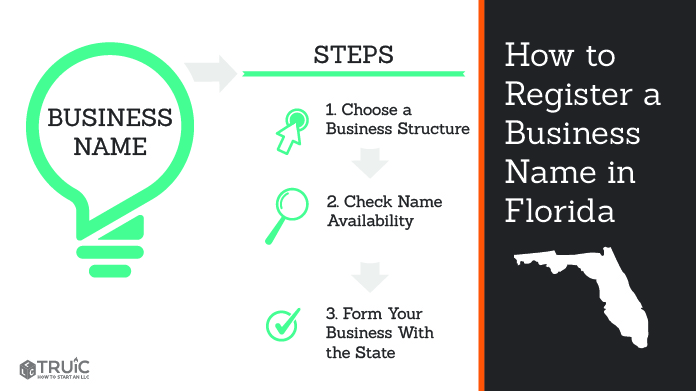

How To Register A Business Name In Florida Truic

Apportioned Alabama Department Of Revenue

Alabama Sales Tax Guide For Businesses